Salesforce FSC, the new-age financial advisors, not only carries valuable information about the client but also carries information on their household too.

It has long been understood that financial advisors get paid the big bucks for taking significant risks and juggling a million balls at the same time.

Keeping track of client data regarding wants, needs, and desires; financial specifications; household information and standard biometrics, while also delivering high-end results was almost impossible.

Unfortunately, a lot of that data often got lost, put on the wrong system, took too long to access, was difficult to interpret or just irrelevant. What that means was a lot of inefficiency and sleepless nights

Balancing datasets across your work desktop, laptop at home, smartphone and tablet requires a lot of syncing and unfortunately, more than a few missed opportunities.

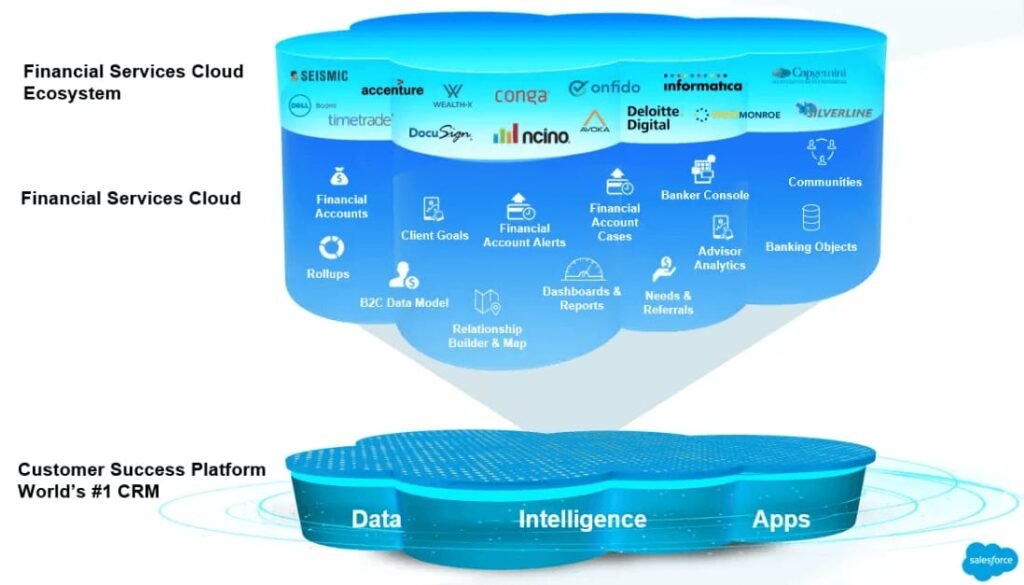

Salesforce Financial Services Cloud

But now, there is a way to stay on top of everything without needing to forfeit much-needed downtime.

Salesforce Financial Service Cloud is the new age Financial Advisor, and it is what clients and advisors have been looking for.

Over 50 percent of clients thought financial advisors didn’t have the technology to keep up with their demands? (PwC Rebooting Wealth Management, 2015). Meaning over half of your clients are unhappy with your service.

Clients want to be able to reach financial advisors at all hours of the day and expect them to have all their data at their fingertips. They want to know you are thinking about them; they want to know they are relevant.

Consider the number of client departures that could have been prevented if the client was made to feel more important.

Salesforce FSC not only carries valuable information about the client but about their household too.

By effectively keeping up with relationships and their demands on your client, you are better equipped to prove that all their concerns matter and are being addressed as well.

The cloud software also factors in your client’s life goals, allowing you to analyze their financial trajectory decades into the future. This then guarantees their lifelong patronage, once you can adequately satisfy them.

Coincidentally, this also gives you the opportunity to lock in the next generation of investors.

But how do you handle all this data without it getting lost, mixed up or overloaded?

Salesforce FSC isn’t the first system to provide data-collation software, but it does make data collection and accessibility seamless.

The software is customizable to your legacy systems, enabling you to decide which information is more relevant, by determining how and where the information is displayed.

It is a step-up from whatever else is out there.

Previously, financial tools provided a one-size-fits-all solution, treating clients as paychecks.

Salesforce is the world’s leading driver of customer relationship management (CRM) cloud systems, meaning the customer always comes first.

By providing customer-centric solutions, the new-age financial advisor can better understand and therefore satisfy clients. The benefits not only include increased approval ratings but more referrals.

EASY TO USE SYSTEM

With one glance, you get a snapshot of all things relating to your client. You are better able to keep tabs on their goals, targets, and assets.

The system also works across all devices, meaning you are on top of all meetings and opportunities all day long, without needing an assistant or eidetic memory.

As a matter of fact, Salesforce Financial Services Cloud is your assistant.

The system keeps you organized with automatic reminders of which leads and opportunities to follow, including those newly assigned to you.

It facilitates collaboration across teams to help bring your client’s needs to bear.

The system eliminates the need for you to be an expert at everything. If your client is looking to buy a house, for example, you can quickly link with the mortgage expert at your firm and a realtor to promptly and easily bring that goal to fruition.

With one easy step, you can access all your client’s financial accounts or relationship accounts.

The system provides real-time analytics, which yields better time-sensitive results.

Information that we previously stored in silos can now be accessed in one place. This means financial advisors can now devote more of their time to completing higher-value tasks and less time on monotonous administrative work.

MAKES MANAGING EASIER

The system also favors managers, by giving them instant access to all the client details without the risk of overloading the system or their workspace.

It also reveals graphically, the performance of the whole company, which then allows you to make key business decisions quicker.

By providing a comprehensive look at client data and advisory solutions, FSC saves time and valuable resources for companies.

The program was created through a collaboration between Salesforce, Accenture, Informatica and Envestnet/Yodlee.

Salesforce FSC not only makes you better at your job, but it also makes it easier and more fun.

From the customer perspective, clients can now get collaborative and personalized solutions quicker than ever before and at a higher level.

Keeping You Ahead

By having all your data on a fully-integrated cloud-based system, you get the upper hand on the competition.

Time spent on more important tasks increases. Financial advisors get better information on what matters most to their clients, including their relationships and their long-term goals.

Whatever is important to the client becomes important to you, and with the intelligent calendar, your tasks are pre-prioritized and color-coded to enable quicker response times.

In lieu of a system that reads minds, this is the next best thing.

Take it with you on your commute, at work or at home. You are always on top of what’s most important, and what’s most important right now is you, getting the tools you need to be your best.

That’s why you need Salesforce Financial Services Cloud. At Plumlogix, we have the expert knowledge to evaluate and implement financial services cloud and grow your business to the next level. Get in touch for more information.